Yield farming is one of those things that sounds super simple at first—stake some tokens, earn rewards, rinse and repeat. But wow, once you dive in, it quickly gets messy. Seriously? Tracking all those transactions across different protocols can feel like juggling flaming torches while riding a unicycle. Something felt off about the whole “easy money” narrative when I started playing around in the Solana ecosystem.

Initially, I thought just hopping between decentralized exchanges and staking pools would be straightforward. But then I realized I had no real grip on my portfolio’s health. On one hand, yield farming promises juicy returns; though actually, without proper tracking, you might be flying blind, risking impermanent loss or missing out on compounding gains. Here’s the thing: if you’re not watching your transaction history closely, you might as well be throwing darts in the dark.

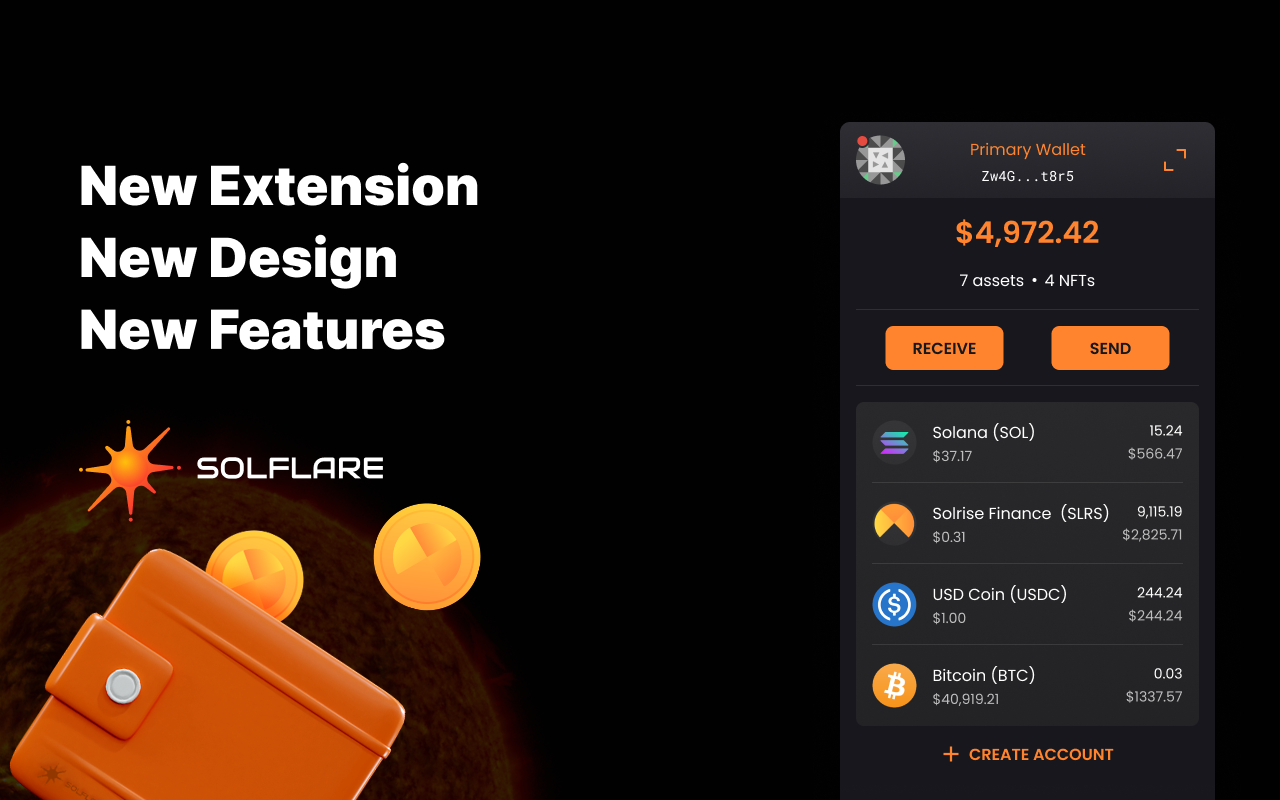

So I started digging for tools that’d make this easier, and that’s when I stumbled upon the solflare wallet. At first glance, it’s just another Solana wallet, right? But nope. It’s kinda like your personal yield farming assistant, quietly keeping tabs on your staking positions, transaction history, and overall portfolio performance. I’m biased, but this part bugs me less than juggling multiple spreadsheets.

Wow! The wallet’s integration with the Solana DeFi ecosystem means that you don’t constantly have to jump between platforms to see how your assets are doing. You get a consolidated view that actually updates in real-time. That was a real “aha” moment for me—finally, a way to track yield farming without losing my mind.

But wait—there’s more complexity under the hood. Yield farming on Solana isn’t just about staking tokens. You’ve got LP tokens, rewards in various tokens, auto-compounding strategies… it’s very very important to understand how these layers interact before throwing your funds in. Otherwise? Well, you might find your “high APY” investment suddenly tanking because you overlooked some fee or slippage.

Transaction History: The Hidden Goldmine

Okay, so check this out—transaction history isn’t just a boring ledger. It’s your story. Every swap, stake, unstake, and claim tells you something about your strategy and risk. When I first started, I barely glanced at mine. Yeah, dumb move. My instinct said “track everything,” but I ignored it, thinking I’d remember. Spoiler alert: I didn’t.

With yield farming, especially on fast blockchains like Solana, you can have dozens of transactions in a single day. Man, it piles up quickly. That’s why tools embedded in wallets like the solflare wallet are invaluable—they keep all that data organized without you having to dig through explorers like a detective.

On another note, the wallet’s UI actually makes looking at your history less painful. Instead of a cryptic list, you get categorized actions, so you can see “Hey, this batch was staking, this was swapping.” It’s not perfect, but it saves you a ton of time trying to piece everything together manually.

Hmm… I did notice some quirks though. Sometimes, when I was farming across multiple protocols, the wallet’s history lagged behind the blockchain by a few minutes. Not a dealbreaker, but it’s worth knowing if you’re chasing those tight arbitrage windows. Patience is key here.

At this point, you might wonder if it’s just easier to stick to one platform. But honestly, that limits your upside. Having a tool that helps you keep track across platforms—even when things get complicated—is a game changer.

Portfolio Tracking: More Than Just Numbers

Here’s where things get juicy. Tracking your portfolio isn’t just about watching the dollar amount go up or down. It’s about understanding your exposure, risk, and how your assets interplay. The solflare wallet does a neat job of grouping your holdings and showing your staking status side-by-side. That’s huge, especially when you’re juggling multiple yield farming strategies.

Personally, I found that having this snapshot helped me rethink some of my allocations. At one point, I realized I had way too much locked up in a low-yield pool just because I forgot to unstake. Oops. That’s the kind of oversight that eats your gains over time.

On one hand, the wallet’s portfolio tracking isn’t as robust as some dedicated portfolio trackers out there, but on the other hand, it’s integrated directly with your keys and staking positions, which means no manual imports or API hookups. That convenience is worth a lot to me.

One thing I’m still figuring out is how to best use the wallet’s data to optimize yield farming decisions without getting overwhelmed. Sometimes I find myself obsessing over tiny fluctuations that don’t matter much in the grand scheme. Maybe that’s just my trader’s bias kicking in…

Anyway, this part of the wallet made me realize that yield farming isn’t just plug-and-play. You have to stay on top of your portfolio actively, or the market will eat your lunch.

Why Solflare Wallet Feels Like Your Yield Farming Co-Pilot

To be honest, before using the solflare wallet, I was juggling multiple tabs, clipboard copies, and half-baked spreadsheet formulas. It was exhausting. This wallet brings a lot of that chaos into one place, and that’s no small feat.

There’s a natural rhythm to yield farming that can be hard to maintain without good tools. You stake, harvest, restake… repeat. But keeping all the numbers straight? That’s a different story. The wallet helps with that by providing transaction history transparency and portfolio tracking that’s close to real-time.

Still, it’s not a silver bullet. I’ve seen some hiccups with transaction syncing after heavy network congestion, and sometimes I wish the UI was a bit more customizable. But overall, it’s a solid companion for anyone serious about farming on Solana.

Hmm… I’m not 100% sure if this wallet will fully replace all tracking tools for power users, but for most folks, it cuts down the noise and lets you focus on what matters—maximizing your yield without getting lost in spreadsheets.

And hey, if you’re worried about security, Solflare’s extension wallet has been around the block and has a good reputation in the community, which matters a lot when you’re dealing with real funds.

Common Questions About Yield Farming and Solflare Wallet

Can Solflare wallet handle multiple DeFi protocols for yield farming?

Yes, it supports a range of Solana DeFi projects, letting you stake, claim rewards, and review transactions across different protocols without leaving the wallet interface.

Is transaction history reliable for tax reporting?

The wallet provides detailed history, but I’d still recommend double-checking with blockchain explorers or specialized tax software to capture everything accurately.

How secure is the Solflare browser extension?

It uses standard cryptographic security measures and is open source, but always keep your seed phrase safe and be wary of phishing attempts.